- Arkansas ended fiscal year 2023 with a $1.161 billion surplus.

- Meanwhile, Helena-West Helena is experiencing a water infrastructure crisis.

- Legislators and SHS wasted no time calling for tax cuts in response to the surplus.

- Historically, tax cuts are an ongoing expense that only benefits the wealthiest.

- Smart surplus spending = investing in projects like education, housing, infrastructure, and work force development.

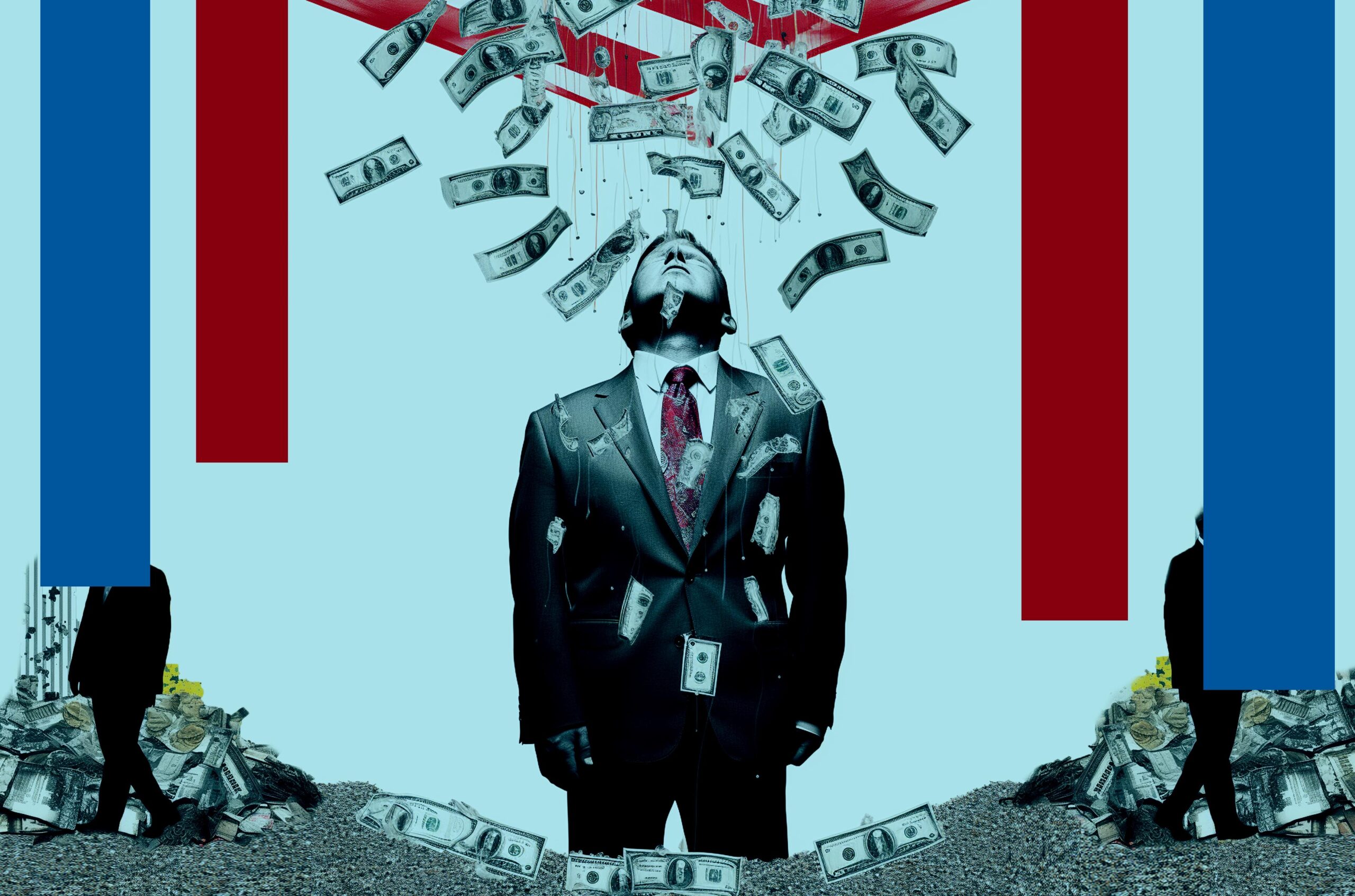

Rapid tax cuts for the rich — a state surplus standard

Arkansas has again reached the end of a fiscal year with over a billion dollars in surplus— $1.1 billion, to be exact.

Lawmakers have already called for tax cuts in response to this surplus report. One conservative nonprofit is even calling for the Governor to convene a special session of the legislature for tax cuts. Governor Sarah Huckabee Sanders has already reminded us she intends to “phase out” the state income tax in a statement from her office.

This response to a surplus is something we have come to expect. Recall that the 2022 surplus was $1.6 billion. Former Governor Asa Hutchinson cut income taxes (mostly for the wealthiest Arkansans) at the very end of his term. Governor Sanders squeezed in tax cuts at the end of the most recent legislative session, despite having passed an underfunded education overhaul and prison expansion.

We can observe a pattern here. Sanders and these lawmakers jump to tax cuts once a surplus is reported, claiming the cuts will bring relief to hardworking Arkansans.

The reality is the average Arkansan benefits very little from the cuts they have historically enacted.

The most immediate and real consequence of not investing surplus funds wisely can be seen in Helena-West Helena. The city is in an ongoing dangerous situation with its water supply. The state offered an “emergency loan” of $100,000 to the city within days of announcing the $1.1 billion surplus.

The best predictor of future impact is past outcomes in similar situations. Tax cuts from this surplus are sure to continue the trend of benefitting the ultra-wealthy while leaving the average Arkansan behind.

Smart surplus spending

Back in August 2022, lawmakers rejected teacher-pay raises under a guise of fiscal responsibility. Their reasoning was something like “a one-time surplus should not be spent on an ongoing expense (such as salaries).”

It’s true that sound fiscal guidance tells us not to use a one-time amount of money for a need that will exist in perpetuity.

What lawmakers forget to tell you is that reckless tax cuts are an ongoing expense.

So which one-time expenses are typically wise for surpluses such as the one Arkansas just reported?

Short-term surpluses should be invested in projects that will offer the state returns for generations to come.

A state surplus can be used to create a thriving economy, but the surplus in and of itself is not evidence that the economy is thriving.

Projects focusing on work-force development, education, infrastructure, housing are all excellent places to start. These can all be investments in a future that improves the quality of life for every Arkansan. Such investments would keep us safer, boost our economy, and meet the needs of the most vulnerable in our state.

Hoarding the state surplus as a political strategy

Building a giant surplus in and of itself is not a fiscally responsible way of governing. Instead, a large surplus offers a political opportunity to those lying about the benefit of their regularly scheduled tax cuts.

Hoarding the state surplus does not help the average Arkansan improve their lives, but it tees up legislators to spin tax cuts and score political points.

The wealthy donors who fund these legislators’ campaigns love hearing “surplus” followed by “tax cuts.” These lawmakers use the surplus as an opportunity to scratch the backs of those they believe they need in order to keep their power. When we find ourselves with a surplus this big and see lawmakers immediately screaming about tax cuts, expect the proposal to come to be of little impact to regular folks.

When Sanders touts a large surplus, she can claim her plan to eliminate income tax is valid and necessary. Meanwhile, one out of four Arkansas kids don’t know where their next meal is coming from, our state’s unconstitutional education overhaul is underfunded, and our infrastructure issues are causing real consequences for our citizens.