This November, Lee County residents will have the opportunity to decide on a proposed 15.7-millage adjustment to the local school property tax. The goal of the proposal is to modernize school facilities and create safer spaces for students, which will benefit families and Lee County’s education system.

The Millage at a glance:

-

- What’s on the ballot? A 15.7-mill adjustment to the local school property tax rate

- What will it do? It will fund construction of a new K–12 school, facility renovations, and career & technical education spaces

- What’s the current millage rate? 28.3 mills (among the lowest in the region)

- What is the proposed new rate? 44.0 mills (approximately the state average)

- When is early voting? November 12th, 13th, 14th and 17th from 8:30 am to 4:30 pm at the Marianna courthouse; No voting on Saturday, Nov. 15th

- When is Election Day? November 18, 2025 from 7:00 am – 7:00 pm; vote at the Aubrey Community Center, the Moro Community Center, or the Marianna Civic Center

- What if I need more info? Contact Dr. Micheal Stone, Superintendent at 870-295-7100 for information on the millage; for election information, contact the Lee County Clerk’s office at 870-295-7700

What’s being proposed to voters

The Lee County School District is proposing to increase its current millage rate from 28.3 mills to 44.0 mills, bringing it closer to the state average. Revenue from this adjustment would fund construction of a new K–12 school campus, renovations to existing facilities, and new spaces for career and technical education.

If approved, the plan would provide:

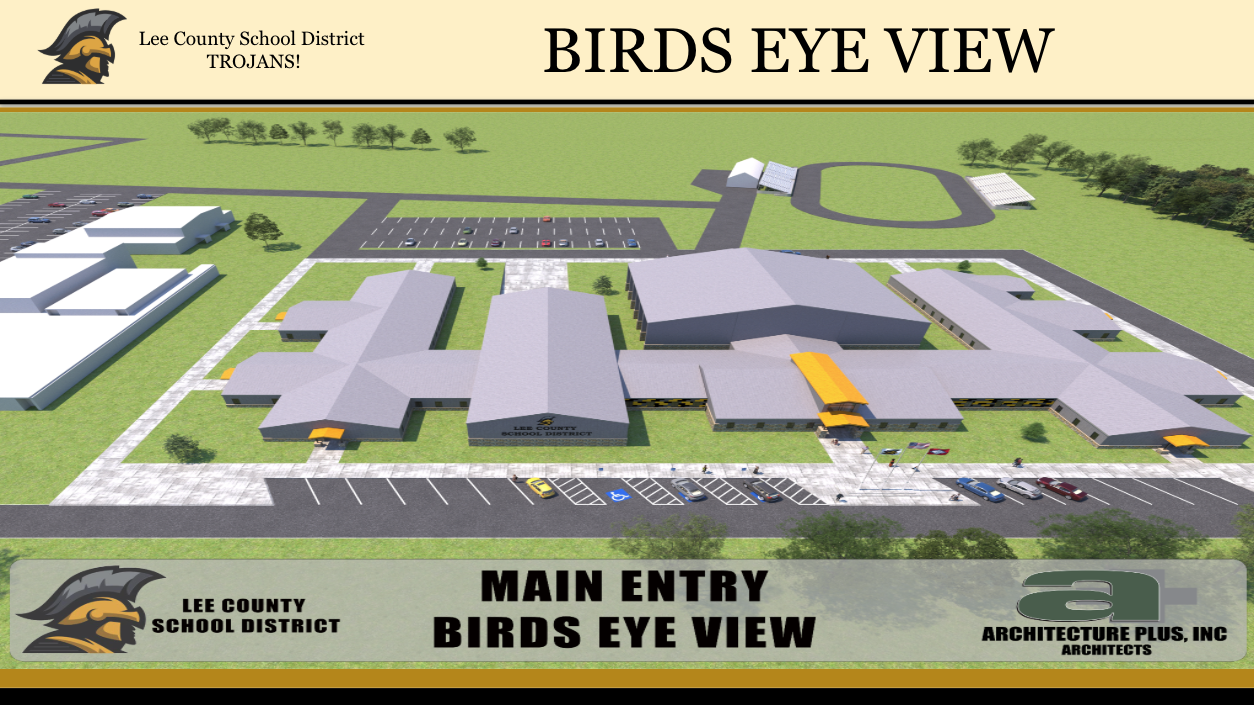

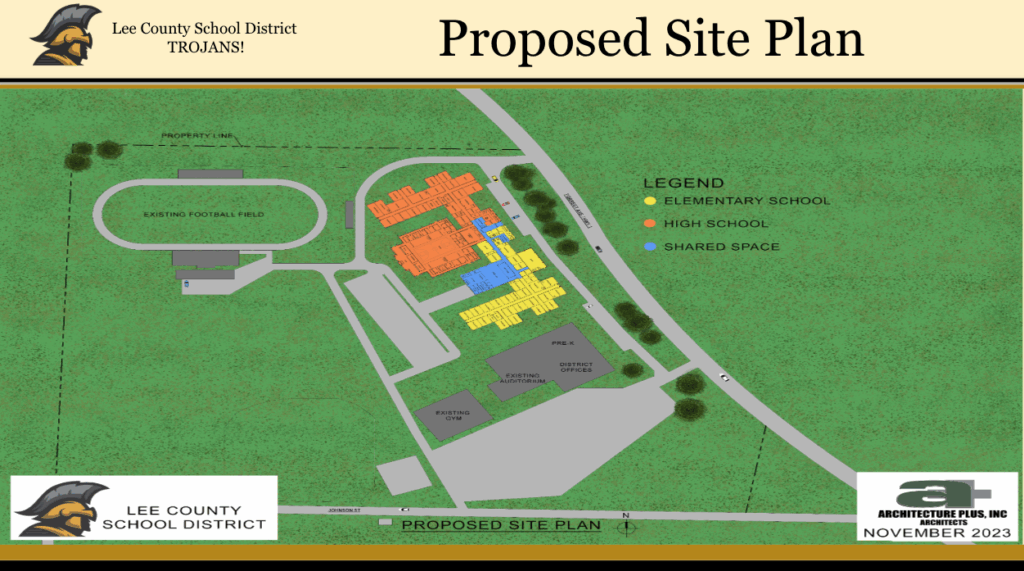

- A new K–12 school building designed to serve all grade levels in one location

- A community safe room and storm shelter

- New academic and athletic facilities, including a new competition gym

- A new career and technical education shop

- Renovations to James Banks Gym and portions of the current high school campus

Why a millage adjustment is being considered

Lee County’s current school millage rate is among the lowest in the region, per the district’s website. Many of the facilities are aging, outdated, and not equipped for modern technology or instructional needs.

Additionally, the proposed increase would help the district provide safe, accessible, and updated learning environments for all students. This includes Pre-K through high school, while ensuring the facilities serve as a community resource for residents.

How the millage funds will be used

| Purpose | Mills | Description |

| New K–12 Building | 11.6 | Construction of a modern school campus |

| Renovations | 2.5 | Upgrades to James Banks Gym & current high school site |

| Career/Technical Education Shop | 0.9 | Modern CTE learning facilities |

| Staff, Operations, and Programs | 0.7 | Support for educational programs and operations |

The financial impact

The change would raise the district’s total millage to 44.0 mills, roughly equal to the state average. Here’s what that means for local property owners:

| Appraised value | Monthly difference | Annual difference |

| $25,000 | $6.54 | $78.50 |

| $50,000 | $13.08 | $157.00 |

| $75,000 | $19.63 | $235.50 |

| $100,000 | $26.17 | $314.00 |

Community benefits

In addition to creating modern classrooms, the proposed project would:

- Provide safer spaces for students and families through the community storm shelter

- Serve as a hub for school and community events

- Offer new opportunities for vocational and technical training to help prepare students for local workforce needs

- Improve property values + community pride

Voting info

- Early voting is November 12, 13, 14, and 17 at the Marianna Courthouse from 8:30 am – 4:30 pm; No voting on Saturday, Nov. 15th

- Election Day is November 18 from 7:00 am – 7:00 pm; vote at the Aubrey Community Center, the Moro Community Center, or the Marianna Civic Center

Residents are encouraged to learn about the proposal here and make an informed decision when they head to the polls.