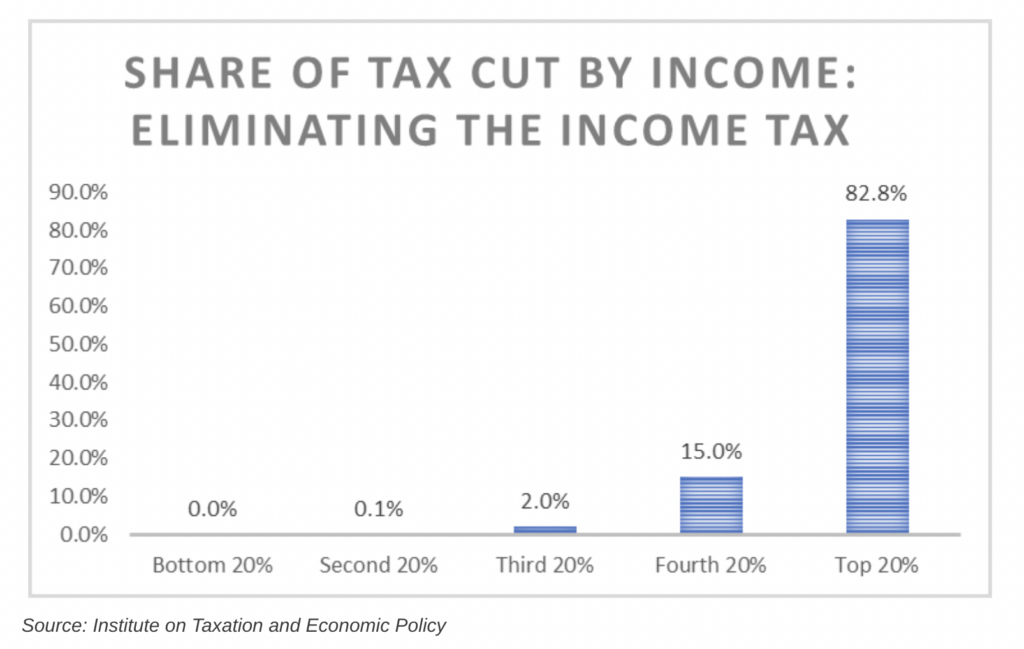

Out-of-state corporations and Arkansas’s richest will benefit most from cuts. And as state programs face endangerment, poor and true middle class families will likely pay to keep services going.

Last week Sarah Sanders announced the first of many promised tax cuts in a move to eliminate the state income tax altogether. But Sanders’ campaign promise of eliminating state income tax comes with significant caution from those who say it will deplete resources needed for important programs.

Unsurprisingly, Sanders bemoaned President Biden’s economic policies in her press conference, stating “This bill is aimed at the hardworking Arkansans hurting most from inflation.” Those close to the Governor tout the cut as good for middle-income Arkansans, but the Institute on Taxation and Economic Policy shows that 80% of the $115 million in cuts will go to the top 20% earners in Arkansas.

Perhaps the most stunning realization from models of this tax proposal is that almost $20 million in corporate cuts will leave the state of Arkansas completely, going into the pockets of shareholders who don’t even reside here. Cutting taxes for the wealthy and out-of-state folks means we have to make up the difference somehow. As a result, Arkansas has the third highest sales tax rate in the country. Sales taxes fall harder on low-income earners, so this is another hit to those who are likely already struggling.

Sanders’ brand of “fiscal responsibility,” a tenet lauded by conservatives, centers the politically convenient message of the moment, regardless of the impact on Arkansans or the truth we deserve to hear. When introducing the tax cut, Sanders mentioned competitiveness with neighboring states like Tennessee and Texas, neither of which have an income tax at all. Nationwide, both states rank near the top in crime and near the bottom in education and healthcare; it stands to reason that their paths are more cautionary tales than examples of good governance.

In Arkansas, tax cuts are valued by many across the political spectrum, but when and how much to cut remains a point of tension, even among GOP politicians themselves. In an interview soon before his departure as Arkansas’s Governor, Asa Hutchinson, who cut taxes more than any governor in Arkansas history, was asked about the possibility of eliminating the state income tax.

“Sure, you could eliminate the state income tax. The question is: Are you going to have to raise other taxes and shift that because you do have to fund education? You do have to build more prisons, handle public safety. The question is: Where are those revenues going to come from[?]”

Hutchinson’s response shows a sensible approach to the conservative value of cutting taxes in the name of fiscal responsibility. His words sit in stark contrast to Sanders’ bombastic promise to do away with the main source of income for the state’s most necessary programs and services, like education and public safety. In recent weeks, Sanders has pushed education and public safety policy through the legislature, and neither policy proposal will have adequate funding if Sanders and the Arkansas GOP continue to cut the state income tax.

Once again, that pesky constitutional requirement to provide adequate free (public) education seems to be a problem in Sarah Sanders’ administration. Some of the most fiscally conservative lawmakers in Arkansas have expressed concern about the LEARNS Act alone; when we add Sanders’ prison reform bill and public safety measures into the mix, it’s hard to see from where the money for both programs will come, especially if she continues the cutting spree. Sanders and her legislative servants have either yet to see the writing on the wall, or they just don’t care.